The powder metallurgy (PM) industry gained in 2017. Metal powder shipments grew modestly. PM tooling and equipment makers reported favorable business levels as well. So did companies producing metal injection molding (MIM) parts. Metal additive manufacturing (AM) the new “cool” in metal component manufacturing continues grabbing headlines internationally.

Metal Powder Shipments & Trends

Manufacturers of traditional metal powders experienced favorable business levels in 2017 and report a positive outlook for 2018. Most powder shipments in North America increased. Companies continue adding new and improved products to strengthen PM’s technology edge. Some of the new products include gas‐atomized alloys for additive manufacturing, machinability‐enhanced powders, magnetic materials, and premixes with reduced levels of nickel.

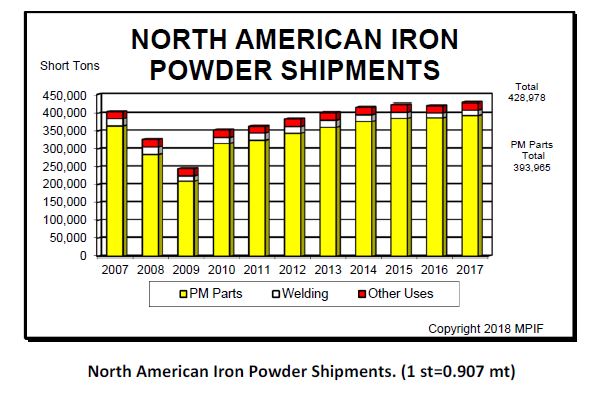

North American iron powder shipments rose by 2% in 2017 to 386,080 mt (428,978 st). PM parts and friction grade powders increased by just below 2% to 354,570 mt (393,965 st).

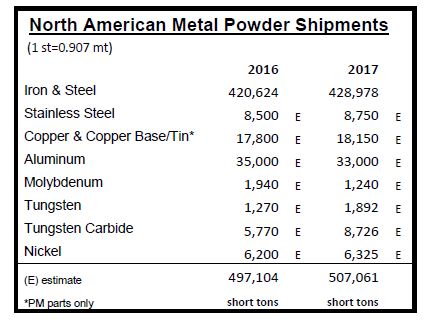

Estimated stainless steel powder shipments increased by up to 3% to 7,936 mt (8,750 st). Copper and copper base/tin powder shipments increased by 2% to 16,462 mt (18,150 st). Aluminum powder shipments for conventional PM reportedly increased, but overall shipments decreased by about 6% to an estimated 29,931 mt (33,000 st). Molybdenum shipments have been reduced due to some production being moved outside of North America, although consumption is up compared with last year. Current shipments are estimated at 1,125 mt (1,240 st). Tungsten powder shipments increased by an estimated 49% to 1,717 mt (1,892 st), and tungsten carbide powder shipments increased an estimated 51% to 7,916 mt (8,726 st). Nickel powder shipments rose by an estimated 2% to 5,737 mt (6,325 st). Overall total North American metal powder shipments increased by 2% to 459,998 mt (507,063 st) in 2017.

Metal powder shipments in Europe last year were stable. PM markets in Asia experienced modest growth with China in the lead.

According to most industry observers, the U.S. market for traditional PM grade powders has stabilized. With existing technology and applications, annual near‐term growth will be modest, ranging in the lower single digits. Without the introduction of new high‐volume PM “champion” parts, the industry will ease into a maturing mode. Nevertheless, MIM‐grade powder shipments will see higher growth numbers along with similar powders for AM applications.

In 2018 the U.S. PM‐grade powder market will most likely flatten. According to observers, and based on robust first‐quarter iron powder shipments, business levels will continue rising at least through June and settle down during the second half. While automotive demand for PM parts will remain fairly stable overall in 2018, markets such as lawn and garden, agricultural, commercial, off‐road, and products connected to home building are gaining.

In the annual PM Industry Pulse Survey conducted by the Metal Powder Industries Federation (MPIF), 78% of the Metal Powder Producers Association (MPPA) members who responded plan on increasing capital spending this year. MPPA members rank the three most significant business challenges they face as: expanding PM applications, an aging workforce, and the impact of the “new” automotive industry. Manufacturing challenges include expanding capacity, developing new materials, and continuous improvement. Most companies are operating above 80% of rated capacity.

PM Parts Market Trends

Parts makers report positive results last year and forecast improving business levels in 2018. In the MPIF Pulse Survey, 68% of respondents expect 2018 sales to increase. Discussions with veteran industry leaders during the first quarter reveal continued growth in the 5%–10% range, depending upon specific market demand. PM companies in western Pennsylvania report good business levels.

Some parts makers see double‐digit growth ahead in 2019–2020. One firm is developing parts for production in the next few years. Developmental times for new parts can range from two to five years. Aluminum PM parts applications continue gaining, especially in the automotive market.

While some pundits have predicted the slow demise of medium‐size entrepreneurial PM shops, nothing could be further from the truth. PM remains alive in family owned businesses passed on to motivated offspring carrying new torches of innovation and creative ideas. Middle‐range PM designs with annual production runs in the hundreds of thousands are still profitable and growing.

For all practical purposes, PM automotive applications are stabilizing unless new champions like connecting rods, main bearing caps, and transmission planetary carriers are designed. Traditional passenger cars have been downsized with small engines and transmissions needing fewer parts. The electrification of vehicles is growing faster than expected and should capture a larger share of the market within the next five years.

U.S. auto sales narrowed by 1.8% in 2017 to 17.2 million units, the first annual decline since 2009. However, there is a bright spot. The resilient light‐truck market remains a heavy user of PM. For example, a 2017 Ford F‐150 truck in a tear‐down project contained 32.46 kg (71.5 lb) of PM parts. Overall, auto builds and sales are projected to be flat in 2018 or slightly down at about 17 million units.

Most members of the Powder Metallurgy Parts Association (PMPA) plan to increase spending on new equipment for capacity and capability this year. In addition, they anticipate adding new employees.

The majority of PM parts makers still face a never‐ending search for skilled and reliable entrylevel employees, an issue faced not just in the PM industry, but by most U.S. manufacturing sectors. Nationwide, unfilled manufacturing jobs run in the millions. In western Pennsylvania, local newspaper classified ads are bulging with job opportunities.

Equipment Trends

PM equipment suppliers (tooling, compacting presses, and sintering furnaces) enjoyed a healthy 2017, and sales should increase again in 2018. Equipment builders and tool makers face the same scarcity of skilled employees as their customers. One company expects a drop in production this year due to the difficulty in replacing experienced retiring employees. Strong trends include more precise tolerances in tooling, more automation in presses and furnaces, and more data collection in equipment operation. Tool makers are designing tooling for seven to eight part levels in shelf dies. Higher precision tolerances for dies and core rods are in the +/‐ 5 micrometre range with face forms at +/‐ 10 micrometre.

Press automation strides continue to reduce handling, integrating machines, and capturing data for customers. Systems include weighing parts, laser measuring of part levels, and applying bar codes on parts for weight and height. Data‐driven decision making is supported by real‐time monitoring and historical trending of equipment aimed at higher quality parts. Eliminating traces of loose powder around presses is another goal in scrap reduction. Press sales are trending to higher tonnages designed for multiple part levels. Automation trends are aimed at reduced handling and increasing output per employee.

Furnace builders are making strides as well. Data collection and automation demands from customers is a given. One example is improving consistency by bar coding to reduce manual input and human handling. Linking an internal work order or router containing barcodes at the customer’s plant to a specific profile allows the furnace operator to scan the bar code on the work order/router which will choose the correct profile saved on the PC. The operator only needs to download the program to the PLC.

Hot Isostatic Pressing & Refractory Metals Trends

The hot isostatic pressing (HIP) market gained in 2017 with increased business from the aerospace industry, both defense and civilian aircraft applications. Oil‐and‐gas markets in 2017 were soft.

This year appears positive overall. The HIP business breaks down to an estimated 70% castings and 30% PM applications. PM includes about 10% densifying metal injection molded (MIM) parts, 5% additive manufacturing (AM) parts, and 15% HIPed superalloy, titanium and tool steel parts. Most HIP companies are busy, straining for capacity, and adding more equipment.

The refractory metals market improved due in part to the stability in the oil‐and‐gas market and from an overall increase in the consumption of tungsten carbide due to improved global economies.

The tungsten market improved in 2017 due to several factors—a slow but steady increase in the oil‐and‐gas market and an overall increase in demand for tungsten carbide from stronger manufacturing in the U.S. and Europe. North American oil‐and‐gas drilling rigs continue to rise in early 2018. Drilling rig count is up 16% today over the same period in 2017 (1,124 vs. 965 rigs). Mining activity showed stronger demand, albeit from very low levels, after several years of being in a highly depressed market. The increased demand is mostly attributable to stronger global economies such as the U.S. and Europe but also, China, whose economy is hovering in expanding/neutral territory. Mining demand for zinc and copper remained strong through the third quarter of 2017 but has slowed down in first quarter of 2018.

2018 looks to be a similar year for refractory metals as global economies continue to remain on a positive trend, energy demand is increasing, and OPEC agreements have reduced oil production.

Metal Injection Molding Trends

Members of the Metal Injection Molding Association (MIMA) report a positive outlook for 2018. The U.S. MIM parts market in 2017 increased up to 5% to an estimated range of $367–$420 million. The industry still includes about 25–30 commercial job shops and 15 to 18 captive parts operations making dental/medical and firearms parts for their own products. The top seven MIM job shops account for more than 50% of the commercial market. It is estimated that MIM‐grade powders consumed in the U.S. (domestically produced and imports) in 2017 increased by about 5% to an estimated range of 1,430 mt (1,577 st) to 1,829 mt (2,016 st). However, some estimate a much larger market at about 3,175 mt (3,500 st).

Automation and process control of the MIM manufacturing process is a continuing trend. MIM parts makers are eliminating waste and handling for quicker processing flow. Narrowing the design cycle of new MIM parts with 3D modeling and mold simulation is another trend.

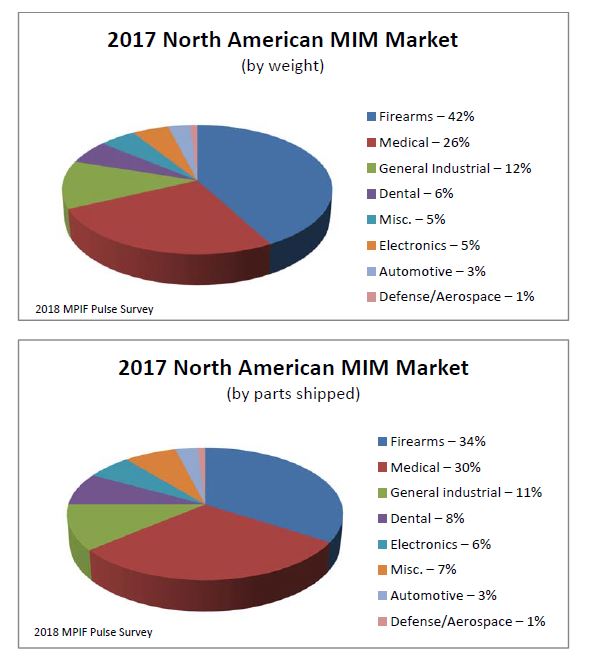

The MPIF Pulse Survey reported the following principal MIM market mix according to weight of parts shipped. In contrast, the number of parts shipped changes the mix somewhat. The firearms and medical sectors still account for more than 50% of the total MIM market, a trend recorded for at least the past five years.

On the heels of a peak year in 2016, U.S. firearms manufacturers faced reduced sales in 2017 impacting MIM parts suppliers that are adjusting to a new norm. Depending upon the national political situation and calls for more stringent national gun controls, the firearms market will stabilize to a more normal supply‐and‐demand model.

Metal Additive Manufacturing Trends

Metal additive manufacturing (AM) is considered by most observers as a complementary technology to existing PM processes. It uses similar powders to MIM but the two technologies offer different design and manufacturing capabilities in terms of part size and production volumes.

Most AM processes use fine gas‐atomized spherical powders in a particle‐size range between MIM and thermal spraying; normally 10– 60 micrometres. Their spherical shape and absence of fines provides improved powder flow, critical for spreading the powder into thin layers. Selective laser melting (SLM) and electron beam melting (EBM), which fabricate parts by melting powder, thin layer‐by‐layer on a powder bed, have made the biggest inroads in AM manufacturing thus far. Fused deposition modeling (FDM) and binder jetting are also developing quickly. FDM and binder jetting are truly PM processes as the built part is a composite of an organic binder and powder and must be debound and sintered. Production rates in most AM manufacturing processes are relatively low at this time. The current target applications are high‐value parts with very complex shapes.

In the MPIF Pulse Survey members of the new Association for Metal Additive Manufacturing (AMAM) overwhelmingly forecast sales increasing in 2018. While some may label AM a “hyped up” business in its very early hyper‐growth stage, AM is attracting serious investments from large well‐capitalized international corporations. Many observers are hopeful that AM will be adopted into commercial products relatively quickly.

Both metal powder and equipment sales for AM applications are strong. The bulk of materials used in AM manufacturing include titanium and cobalt‐chrome for medical implants, cobaltchrome for aircraft nozzles, and superalloys such as Inconel 625 for aerospace products. Medical applications include knee, hip, jaw, shoulder, and skull implants.

The AM business seems to be changing almost monthly according to observers. While SLM and EBM are the dominant manufacturing process today, processes such as binder jetting and directed energy deposition are also jockeying for attention. AM should remain the PM industry’s poster child for the immediate future.

Technology Trends

The MPIF Technical Board continues to encourage and generate programs to advance PM technology. For 2018, the Tech Board developed the special interest program “Energy Generation & Storage Technologies,” an outgrowth from the PM Technology Scan—2017 “Review of Battery Technology for Potential Future PM Applications.” In addition, it developed the PM Technology Scan—2018 “Machinery Sensors & Information Technology,” stressing the ability to control processes is directly related to monitoring the variables driving the process.

The MPIF Technical Board and the Center for Powder Metallurgy Technology (CPMT) continue to collaborate to advance PM through outreach activities. For example, the National Science Foundation (NSF) and the annual CPMT/Axel Madsen Conference Grants provide funding for university students to attend POWDERMET2018/AMPM2018. Students are provided the opportunity to engage with other university students, exchange activities at their universities, and are paired with Tech Board mentors to guide them through the conference and receive feedback from the students. CPMT has provided over $140,000 in conference grants to 109 students since 1990, with an estimated 25% of the recipients remaining connected to the PM industry. Additionally, CPMT scholarship awards, which are separate from the grant program, have surpassed $500,000 to nearly 150 students since 2000.

Future Perspective

Opportunities within the industry are substantial. PM will continue innovating with new processes and products. 98% of the MPIF members that responded to the 2018 PM Pulse Survey believe sales will remain the same or increase in 2018. All six of the federated trade associations report a lack of skilled employees and are concerned with an aging workforce. The PM industry needs to address this shortage of employees to support growing sales. NSF and the CPMT/Axel Madsen grants put young engineers into the pipeline. Now it is up to us to attract and retain these young engineers, a key to our industry’s continued success. Without a doubt, powder metallurgy will persist for many years to come as an important manufacturing process and technology. The industry has a rich history of creative and resourceful PM practitioners overcoming marketplace challenges, reinventing itself by adopting new technologies and entering new markets. In the end, we are still a unique industry with a bright future, prepared to meet and conquer all obstacles.